You’ve come so far.

And you’ve got more room to grow, more aspirations, higher goals. You’ve decided that finally finishing your bachelor’s degree could be the ticket to that future you envision for yourself. But how can you fit finishing your bachelor’s degree into an already full life?

Completing your business degree online through UW–Madison could be the answer. Why get an online degree?

It can be overwhelming to figure out whether online degrees are worth it, which programs are the best and what’s the right degree to get you where you want to go.

Take a deep breath because we’re here to help. Read on to get answers to some burning questions about completing your degree online.

Jump around

- Are online degrees respected?

- What makes a top online degree program?

- Are online degrees worth it?

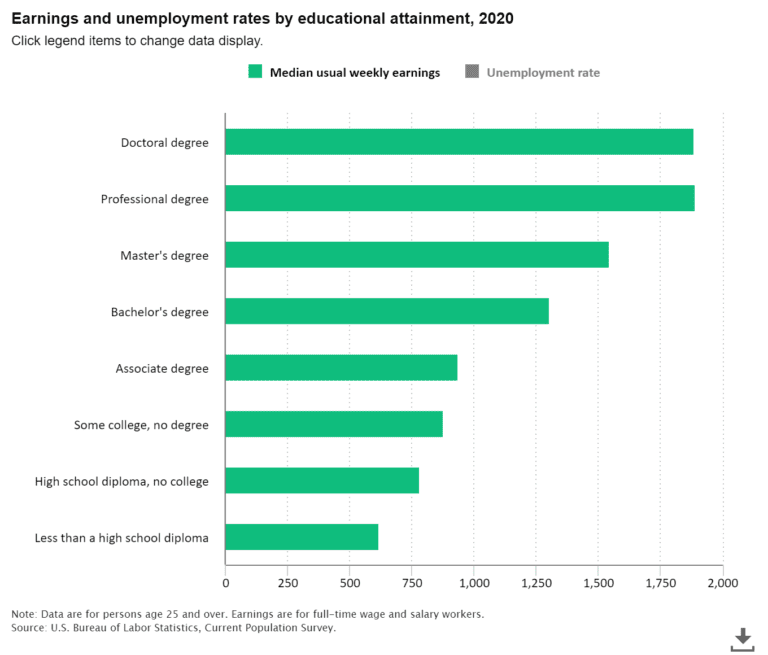

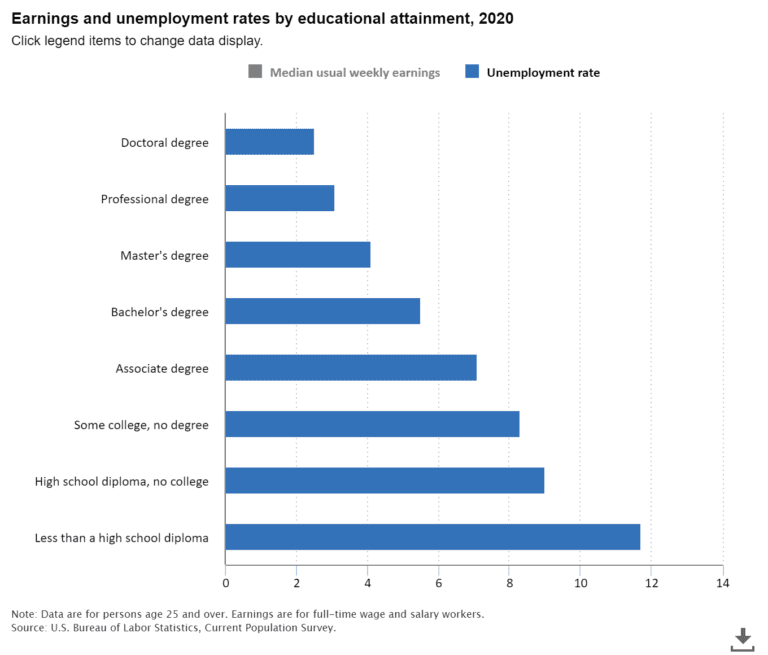

- Education pays. These charts tell the story.

- How hard is it to get an online degree?

- Hear from one of our enrollment coaches.

- How fast can I get an online degree?

- How much does an online degree cost?

- What kind of online business degrees are available?

- What can I do with an online business degree?

- Where can I get an online business degree?

- Read more about being an online Badger

Are online degrees respected?

Yes.

That’s the short answer.

Long answer: Steep technology advances, along with lessons learned from COVID-19 about online learning, helped us normalize and elevate online education.

Even employers’ perspectives on online degrees have changed.

According to research (1), 61 percent of HR leaders firmly believe that online learning is of equal or greater quality to more traditional methods and 71 percent of organizations indicated that they had hired a job applicant with an online degree in the last 12 months.

But – and this is important – an online degree needs to come from an accredited institution. That matters to employers.

In higher education you want your institution to be regionally, rather than nationally, accredited because regional accreditation tends to have more rigorous quality standards than national accreditation. For example, UW–Madison has been regionally accredited since 1913 by the Higher Learning Commission, an organization that accredits institutions in a 19-state region.

Employers – hungry to fill positions – are also more focused on the competencies of potential employees rather than whether they sat in a physical classroom or learned those skills via an online learning platform.

Finally, getting a degree online requires qualities that employers seek, like flexibility, responsibility and grit. Employers respect students who’ve been able to balance career, family and other obligations with school.

And, if you graduate from UW–Madison Online, you’re a full-fledged Badger: Your diploma will be from the University of Wisconsin–Madison.

Learn more: How to talk with potential employers about your online degree.

What makes a top online degree program?

You don’t just want to be respected – you want to be fulfilled and find the right educational fit!

In addition to accreditation, what makes an online business degree program stand out among the growing list of educational options online?

Here are some additional things to think about when considering online options for a business degree:

Engaged and experienced faculty. Ideally, the online program you’re pursuing will be taught by world-renowned faculty with expert credentials. In many cases, they will be the same faculty who teach students in person on campus. They should support your knowledge base, skill building and academic achievement. Consider faculty members’ areas of research, how they are ranked in their field and any professional recognition they’ve received.

Quality curriculum. Ask enrollment coaches or other support staff at your potential online school about the courses they offer. Are they based on solid research and expertise? Are they designed specifically for online students by experts? Will they increase your critical thinking and communication skills?

Student support. Most colleges offer a full suite of services to help students succeed and plan for their futures. Find a program with coaches and advisors dedicated to your success as an online student. Take a careful look at what academic and support resources are available to you. If you are unable to find this on the school’s website, ask an enrollment coach or support staff.

Dynamic online learning platforms. As you juggle school, work and life, you don’t want to struggle with technology. Make sure the online program you’re interested in is user-friendly, with tech support readily available. The online learning space should also have a dynamic interface and opportunities for plenty of collaboration with peers and instructors.

Alumni support. Once you have that degree in hand, a network of peers will come in handy. Look for a school with active and welcoming alumni. After all, networking is still the most effective way to find a job. Research states that some 80% of jobs are landed through networking. (2)

Networking works. Find your Wisconsin Alumni Association chapter.

Learn more about how to network with alums, and why it’s so beneficial.

College and program ranking. Notice this is last on the list. Some experts say college rankings aren’t nearly as important as they’re made out to be. (3) But rankings can be another indicator of quality, particularly when you’re focusing on a specific area of study. All colleges have strengths and weaknesses. Look for rankings of degrees and schools within a university.

All online degrees are not created equal. Find a quality program that fits your needs and is led by experts with wrap-around support services to foster your success.

Are online degrees worth it?

You still may be wondering if the time, effort and money you put into an online business degree are going to pay off in the end.

Let’s talk about it.

We’ve already busted some myths about the quality of online bachelor’s degrees – they can be just as valuable and meaningful as in-person degrees. For instance, if you graduate from UW–Madison Online, you’re still a Badger through and through.

True or false? Read some more myths about getting an online degree.

Chart: Comparing UW–Madison Online and in-person degree programs.

Now let’s talk about flexibility and affordability.

You may not be in the position to live on campus and dedicate your life full-time to finishing your bachelor’s degree. Good news – you don’t need to do that.

Student story: How Kristy found her path to a bachelor’s degree.

Online degrees give you the ability to keep your job, commitments and earning income while pursuing your education. Many programs allow you to learn from anywhere you can access materials online, on your own time.

Plus, you apply what you learn in real time. Watch a lecture on operations management and discuss with peers in the evening; use what you learned the next day on the job.

Student story: Dan talks about how he applied his learning immediately in his career.

Online programs aren’t always more affordable, but they can be. Remember what we talked about above: You get what you pay for. And don’t forget, in a part-time program you can still earn while you learn.

Finally, getting that bachelor’s degree gives you the opportunity for a higher salary and more career opportunities. According to the Bureau of Labor Statistics, workers who have higher levels of education earn more and have lower rates of unemployment compared with workers who have less (4).

How hard is it to get an online degree?

Good question!

Online degrees provide more flexibility, but they’re no easier than their in-person counterparts. They require the same number of credit hours – typically 120 – and if it’s a respected, accredited program (reminder: it should be), you can expect the same rigor as you’d find on campus.

It’s important that your online degree holds you to high standards. Your online degree should challenge you so that you can obtain those skills and competencies you’re after.

Learn how John is applying skills and knowledge from his UW–Madison Online degree in his job.

A reputable school will provide you with the infrastructure and support you need as an online student to tackle tough courses and finish your degree.

Do your best online work: Check out these 5 study tips and 4 study tools.

Here are some questions you can ask about an online school to make sure your online student experience sets you up to succeed.

1. What’s the learning system at the school? You want a learning platform that’s simple, with an intuitive interface and plenty of options for interaction with faculty and peers.

2. What kind of online community exists? As we now know since the explosion of remote work, online communities can enrich your degree and experience. Read more about how to build an online community.

3. What support services and personnel are available for online students? Any good online program should include a slate of student services to help support your success – from academic advisors and financial aid, to career counselors and alumni networks.

Check out this Q&A with two UW–Madison Online academic advisors — you’ll learn how online advising works and why they love what they do.

How fast can I get an online degree?

If speed is a priority, don’t let what we’re about to say stop you.

There are accelerated online programs that might help you get your bachelor’s degree in two years. But that could come at the cost of quality and flexibility.

If you want to work, earn a salary and meet your other obligations while in a top program, a part-time option might be worth the extra time to the finish line.

How long it takes to earn your degree generally depends on how many credits you’re coming in with, how many credits you have time to take per session and what degree you’re getting. It could be anywhere from two to six years.

Transferring to UW–Madison Online is as easy as 1-2-3.

Remember, to get your bachelor’s degree, you’ll have to meet that credit requirement (usually 120 credit hours) and all degree requirements. If you come in with 60 credits from previous programs (that are accepted by your new program), you’re halfway there!

But even if you’re signed up for the full credit load, don’t fret. Many online programs offer fast track course sessions. What’s that? Most campus-based degree program classes are 16 weeks long. Some online degree programs offer courses that are just 8 weeks long, so you can complete a course in half the time.

And online programs have that added benefit of flexibility. Many allow you multiple start options, not just fall. Want to jump in this summer or next spring? Entirely possible in the online education arena.

How much does an online degree cost?

Let’s get right to it: According to U.S. News & World Report, in 2020, the average online bachelor’s degree ranged from $38,496 to $60,593 in total program tuition cost. (5)

Consider these critical points when comparing costs of online college degrees:

1. Availability of financial aid. Online students may still be eligible for an array of federal, state and institutional aid by submitting the FAFSA, the Free Application for Federal Student Aid.

• An enrollment coach can help you explore your financial aid options.

2. Opportunities for grants and scholarships. Outside of federal or state aid, do some research on other sources of funding for your online education. Local organizations and professional groups offer support based on your background, achievements and professional goals.

• Tips on funding your return to college as an adult student.

3. Employer support. Have you talked with your employer about going back to school? Some employers pitch in to help pay for education expenses. And some schools offer employers a discount for their staff.

Take time to delve into other costs associated with being an online student – technology or daycare, for example. But, in general, finishing that bachelor’s degree online, versus on campus, could save you money.

What kind of online business degrees are available?

Now, down to business.

Whether you’re looking for a general business bachelor’s degree or one well-suited to your specific career goals, you’ll find an online business degree to fit your needs. From accounting to supply chain management, online business degrees are plentiful.

Just one example: See how an online human resources degree can unlock opportunities.

Start by getting back to the basics. Journal for five minutes each on these questions:

- Why do you want to earn this bachelor’s degree in business?

- What do you want to achieve in your career with this degree?

- How will this degree benefit you/your loved ones’ lives?

Student story: Read about how Troy came back to get his bachelor’s degree at the Wisconsin School of Business.

Once you have your reasoning and goals in mind, you’re ready to research programs. Find accredited schools and well-ranked programs and dive into their websites. Look at concentrations offered, required coursework, faculty, opportunities for networking or internships, alumni connections and how long it takes to get finish your degree.

Make sure all these parameters align with your goals.

UW–Madison offers a variety of online business degrees in human resources, management and marketing.

Explore which UW–Madison Online degree is right for you

What can I do with an online business degree?

You can take a business degree in so many different directions; the career possibilities are endless. Online business degrees have evolved to offer students a multitude of marketable skills and opportunities for advancement.

Learn how Manny Avila is planning to boost his career with an online business degree.

According to the U.S. Bureau of Labor Statistics, overall employment in business occupations is projected to grow 7 percent from 2021 to 2031; this increase is expected to result in about 715,100 new jobs over the decade. (6)

Your bachelor’s degree in business could lift you to a supervisory, managerial or director role, to a new role in a different industry, to opening your own business, or even to enter graduate school. Along with learning targeted business knowledge, a solid online business degree will boost your communication and problem-solving skills – useful at home and in your work life!

And you can make a very good living with an online business degree. In 2021, the median annual wage for roles in business was $76,570, which is $30,000 more than the median annual wage for all occupations. (7)

Check out these top business careers and corresponding salaries from the Bureau of Labor Statistics. (8)

And, you can help people and give back to your community in a business-related career. What’s not to love?

Where can I get an online business degree?

As you may have gleaned, online business degrees are plentiful; you can get an online business degree from a variety of accredited institutions.

But buyer, beware. Use caution when searching for the online business degree that best aligns with your needs and goals.

While UW–Madison Online first started offering degrees in 2020, the consistently high-ranking and world-renowned Wisconsin School of Business was founded in 1900. Students have been earning business degrees from UW-Madison for more than 100 years.

Read why Joey calls his UW–Madison Online business degree program ‘The very best education’.

We hope you learned a little more about online business degrees. If you have more questions about applying for online business degrees – or other online degrees – don’t hesitate to reach out to our enrollment coaches.

We look forward to connecting with you!

There are many tried and true ways of succeeding in the classroom for any type of learner. Following are some of our tips for being a top online student.

Dan Barry transferred from Madison Area Technical College to UW-Madison Online, where he'll earn his Bachelor of Business Administration (BBA) in Business Administration–Management while continuing to work and raise his family.

The enrollment coaches at UW–Madison Online have put together five things you should evaluate when looking for an online program to earn your bachelor’s degree.