Read about John Gloeckler’s challenges and triumphs as he finishes his bachelor’s degree as a returning adult student at the University of Wisconsin–Madison.

Read about John Gloeckler’s challenges and triumphs as he finishes his bachelor’s degree as a returning adult student at the University of Wisconsin–Madison.

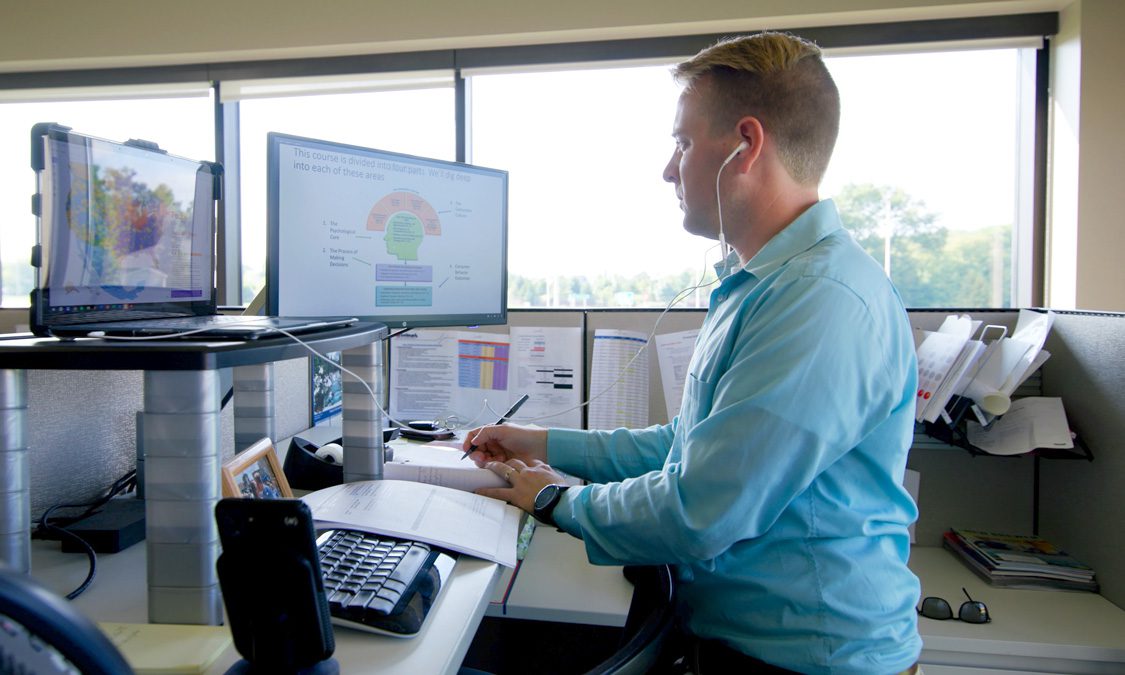

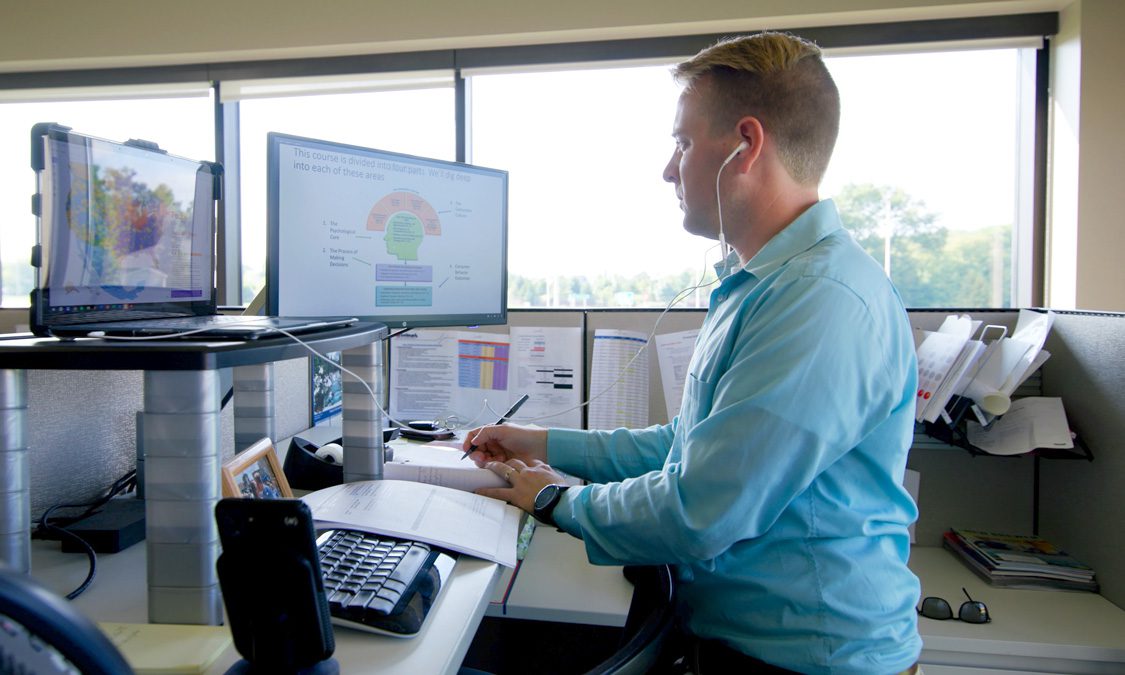

Check out Joey Nicgorski’s story of how he ended up at UW–Madison Online to get his bachelor’s degree in marketing, and how he plans to use his degree to advance in his field.

Learn how Manny Avila is making time in his busy home and work life to pursue an online bachelor’s degree from the University of Wisconsin–Madison.

Read to find out how an enrollment coach can help you navigate higher ed, answer your questions and choose the best path for you.

Read about how Kristy Jorgensen is fulfilling her Badger dream with an online bachelor’s degree in consumer finance and financial planning.

Read about how Wisconsin School of Business student Troy Marinkovic came back to finish his degree and the other big plans he has for his future.

Discover the value of an alumni network, how it can benefit your career, and the steps you can take to get involved, both pre- and post-graduation.

Should you earn your bachelor’s degree online or in person? This helpful chart breaks down the differences and similarities between these two learning formats.

Learn how to talk to potential employers about the benefits of your online undergraduate degree, and how it will help you thrive in a job.

Karen and Leanne provide online academic advising and career support to students. See what they have to say about student success and why they love what they do.